I'm sure we have all traded a call option that declined in value even though the stock price increased. I have done it many times before I started focusing on option selling strategies. We all know that stocks and options are completely different investment vehicles.

Remember: a stock's price is just one of many factors that impact an option's value.

Options pricing is tricky and can be downright confusing without some simple guidelines to follow.

This is NOT uncommon

At first, it may seem like something is going wrong. You thought the stock would rally, and so you bought a call. Now the stock is higher (as you predicted), yet you're losing money! What's going on??

I can assure you it's not uncommon to have this happen. In fact, this happens each month to thousands of traders. That’s why understanding options pricing is so critical to your success.

Stock price and strike price relationship

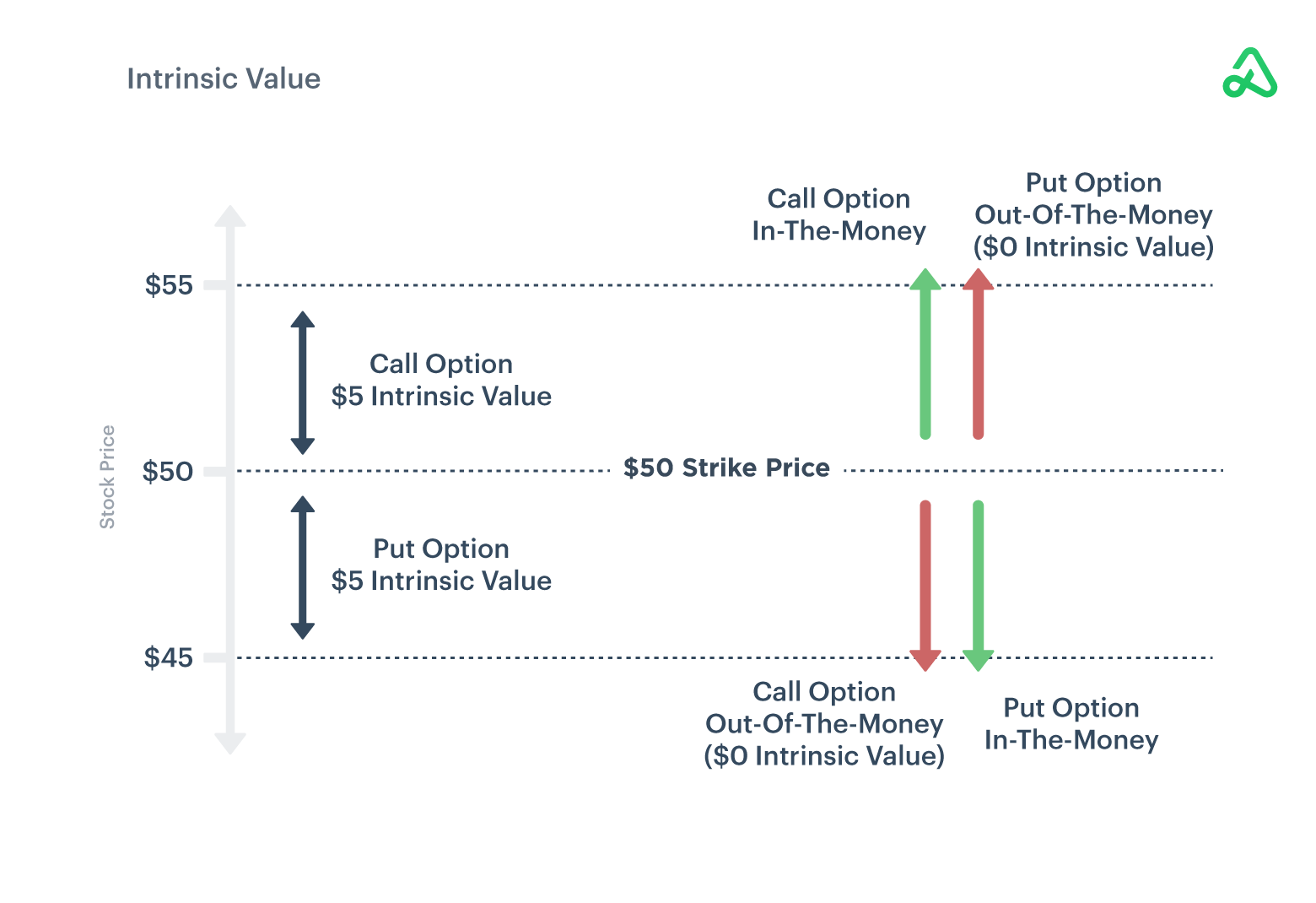

Moneyness is the most important factor when determining the value of a stock option. The strike price is the price that a call buyer may purchase shares at or before expiration.

When the stock price is above the strike price, a call is considered in-the-money (ITM). The situation is reversed when the strike price exceeds the stock price — a call is then considered out-of-the-money (OTM). An at-the-money option (ATM) is one whose strike price equals (or nearly equals) the stock price.

Your call option may be losing money because the stock price is not above the strike price.

Time value decreases rapidly

Time value, or theta, is your worst enemy as an option buyer because it erodes the value of your call option each and every day. Therefore, an option’s value at expiration is only the amount it is in-the-money (ITM).

Stock traders don’t have to worry about time value because they can own a stock for years. But options have a finite life that ends at expiration. So the stock price must rise higher than your strike price before time decay eats away the value of your option.

An OTM option has no intrinsic value, so its price consists entirely of time value and volatility premium, known as extrinsic value.

Long call option example

Let's look at this long call option. The call option strike price is $170, and the stock price is $180.21. Plus, when I bought this call option, the stock price was at $169.22. So, the stock went up and is above my call option's strike price, but the position is losing $20! How can this be?

First, we must consider the position's breakeven price. The call option cost $16.15, so the breakeven point is $186.15, meaning the stock must be above that price at expiration for the position to make money.

Second, I entered the trade one month ago. So, even thought he stock price increased, the option's time value has decreased.

There are a lot of factors working against long options. That doesn't mean they can't be profitable, but we can often find trades with better probabilities and expected value if we want to be successful options traders long-term.

Decreased market volatility

As I mentioned above, OTM options are mostly based on time value and volatility premium. Volatility is simply the propensity of the underlying stock to fluctuate in price. The more volatile a stock, the higher the chances of it "swinging" towards your strike price.

The higher the overall implied volatility, or Vega, the more value an option has. Generally speaking, if implied volatility decreases then your call option could lose value even if the stock rallies.

Underlying stock dividends

Dividends increase the attractiveness of holding stock rather than buying calls. This is because call buyers are not entitled to the dividends until they actually own the stock. You can't have your cake and eat it too, right! Therefore, larger dividends reduce call prices overall.

Interest rates

I bet you never thought interest rates affect an option's price, right? Well, they do to a certain extent, and it's another Greek - Rho. As interest rates rise, call option premiums increase.

Higher rates increase the underlying stock’s forward price (the stock price plus the risk-free interest rate). If the stock's forward price increases, the stock gets closer to your strike price, which we know from above helps increase the value of your call option. On the flip side, decreasing interest rates hurt call option owners.

.png)