Screener

Find tickers to trade based on integrated options liquidity research

The Screener got a major update to help us find the best underlying symbols to use for options trading, including:

- New filter and stats for options liquidity.

- Copy and paste symbols to quickly create watchlists.

- New filter for symbols included in Trade Ideas.

- New filters for earnings and dividends.

- Additional columns and filters available under the button in the table header.

Trade Ideas

New filters for out-the-money % and spread width in Trade Ideas

These new filters give us additional ways to find the trade we are looking for in Trade Ideas. We also added both filters to "Position Criteria" in the Open Position and Open Trade Idea actions for automated trading!

- Filter by the percent the trade is out-the-money (OTM %), e.g. a call spread with a $103 strike price in a $100 stock would be 3% OTM.

- Filter by the spread width, e.g. a call spread with a $100 short leg and $102 long leg has a $2 spread width.

Bots

Bot Watchlists are more flexible and powerful

The first version of bot watchlists were limited to a couple filters and sorting options. Version 2 offers many new options for filtering and sorting and removes the requirement of including symbols with open positions.

- Filter symbols by 14 different technical indicators

- 6 new options for sorting symbols including liquidity and random

- Choose to filter out symbols with open positions

New decisions that factor in slippage when checking if positions are winning or losing

These new recipes can be combined with SmartPricing's "Up to [$X] slippage from the mid price" final price setting to ensure positions only exit for a price that meets our profit taking or stop loss decision criteria.

Organize your bots into groups to track positions and stats

This is the first step towards being able to manage bots as a group. Currently, you can only use groups to filter for consolidated stats, analysis and positions but we envision this opening up a new realm of possibilities for decisions and other automated trading features in the very near future.

Selectively turn on and off individual automations

Sometimes we may want to turn 1 or more scanner automations off so the bot doesn't open new positions but leave monitor automations running to manage existing positions.

Note: The master "Automations" switch can still be used to override this option and turn off all automations for the bot.

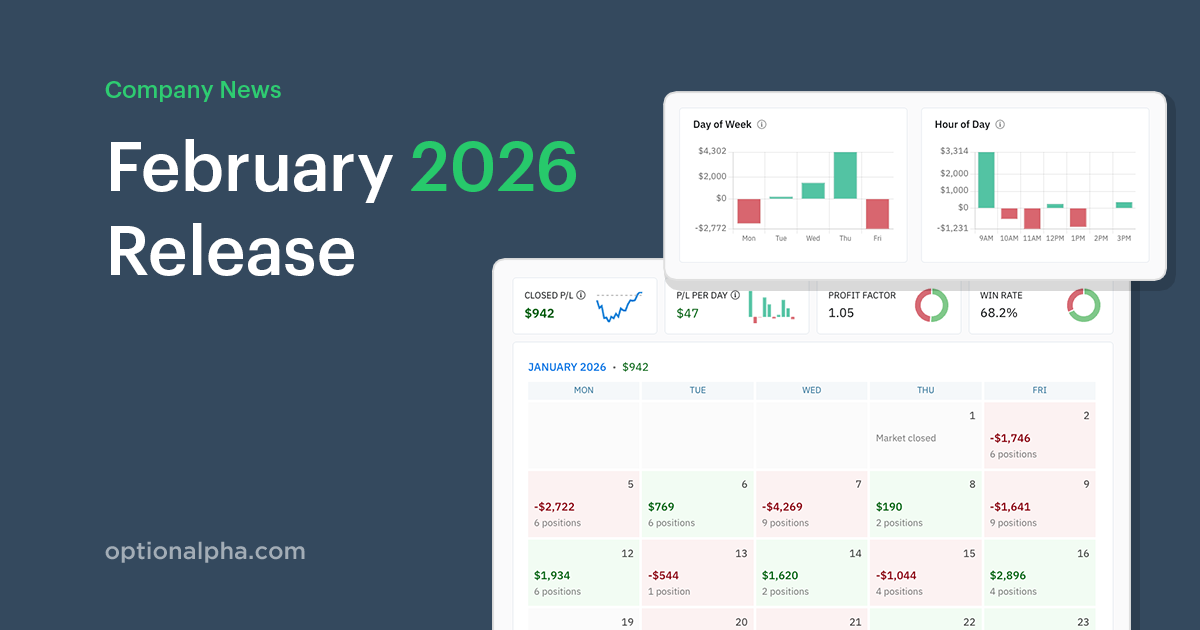

Calendar

Find important events for options traders in the updated Event Calendar

The calendar got a makeover with a new intuitive month based interface for browsing events.

As part of this update we also added a 2nd datasource for earnings events to ensure the data our bots are using to trade has the most complete dataset possible.

Additional updates worth mentioning...

- Auto-detect orphaned inputs in the automation editor and display a warning.

- Copy symbols in Trade Ideas search results to quickly create and update watchlists.

- Added "Expected Move" to Earnings, calculated using the IV of the ATM call and put options in the expiration immediately following the earnings report.

- New decision recipe for comparing a symbol's IV vs HV.

- Added volatility ratio to symbol value decision and the Screener.

- Improved layout and scrolling on mobile.

- Market holidays added to the calendar.

- Ability to link to a position's symbol in the automation editor.

- Fix for the bug that caused page loading to hang sometimes, forcing a browser refresh (finally found it!!).

- Fix for symbols with ex-div showing up in Bot Symbols.

.png)

.png)