Most traders are used to doing everything manually when it comes to options trading: hunting for new ideas, analyzing potential trades, and watching positions. But with automations, you can finally leverage technology to improve your trading and free up your valuable time. Let's help you understand the basics of automations and how to use them for trading.

What are automations?

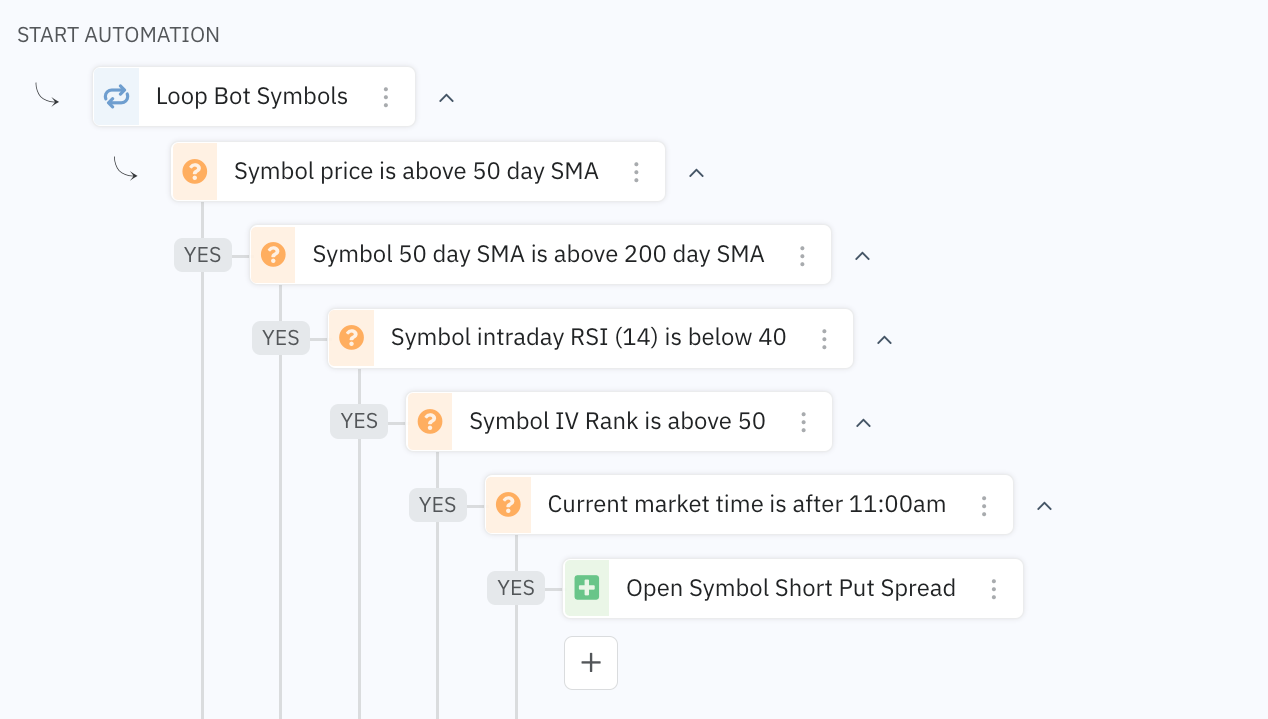

Automations are simply a set of instructions you give the bot to perform. The automation tells the bot exactly what to look for, what decisions to make, and what actions to take if necessary. Plus, each automation you build is completely flexible, so you can put actions and decisions in whatever sequence or order you want the bot to go through when the automation runs. It's an entirely new way of trading focused on helping you become a more disciplined and systematic trader.

What can automations do for me?

Automations can evaluate market data, check potential trading opportunities, make complex trading decisions, open positions, close positions, send notifications, and so much more. Here are just a few examples of what you could have an automation do for you:

- Watch SPY for a 1% drop intraday and open a new short put spread position, then close that position when it reaches a 25% profit.

- Scan a list of symbols for high implied volatility and open new iron condor positions on those symbols.

- Wait until 1 pm, then check a list of symbols to see if any symbols have a technical buy/sell signal and open one new position in each symbol.

- Monitor any option position for profit targets, stop-losses, or nearing expiration all at once and trigger an automated closing order if any exit criteria are met.

- Close any position that is less than 3 days from expiration only if it's ITM and profitable by at least $100.

Is this all you can do with automations? No way; this is just the tip of the iceberg. Remember, automations are just a set of instructions (steps/actions/decisions) for the bot to perform when the automation runs. They can be as simple or complex as you want.

Add an automation in 2 steps

Building and adding an automation to a bot only takes two steps. Plus, since bots can run multiple automations, you can repeat these two steps for each automation you add to your bot.

1. Create automation

Creating a new automation is as simple as telling the bot what to do when the automation runs. Inside the automation editor, you'll add steps to your automation in the order and sequence you'd like them performed by the bot. The steps you can add to an automation are broadly categorized as either:

- Actions: These tell the bot to perform a specific action, such as making a decision, opening/closing a position, sending a notification, and/or tagging.

- Loops: These repeat the same subsequent actions for each symbol in a list of symbols or each position currently open in a bot.

With the flexibility and control to build automations using actions and loops, you can run virtually any automated (or semi-automated) trading strategy you want, from the most simple trend trading strategy to a highly sophisticated self-hedging, volatility adjusting strategy.

2. Schedule automation

Once you've created your automation, you'll need to schedule the automation to tell the bot when you want the automation to run. There are three main ways you can schedule an automation:

- Continuous: as either Scanners, which run every 15 minutes by default to find and enter new positions only if the bot is under its position limits, or Monitors, which run every 15 mins by default only if the bot has an option position to monitor and helps close positions when your criteria are met. You can also self-select 5-minute and 1-minute scans. Scan speeds are set at the bot-level; each bot defaults to 15 minutes unless you select a different speed.

- Triggers: run an automation on a specific Date, on a Recurring Schedule, when the Market Opens/Closes, or when a Position is Opened/Closed. These triggers run the automation one time when each event occurs.

- Manual: with custom Buttons that are added to your bot dashboard so you can run any automation instantly with the click of a button.

Automations are 'OFF' by default. Turn automations 'ON' and they will run at the scheduled intervals.

The schedule tells the bot how often or under what conditions the automation can run. You can edit/adjust the schedule at any time and even order automations to run before other automations if you have multiple types running inside your bot.

Save, Reuse & Copy Automations

You can save automations to your library and create multiple folders to organize them all. Automations can also be shared across multiple bots.

Any changes made to an automation will flow through anywhere the automation is used, including other bots.

You can copy an automation and make changes to the new version without impacting the original.