Traders, we know how overwhelming managing all your open positions can be. You know the drill: once you open a new position you have to remember to come back, day after day, and babysit your new position. You have specific criteria for managing your position based on performance, expiration, and earnings announcements. With a portfolio of multiple positions, it's a lot to keep track of and time-consuming responsibility.

Then, if you're lucky to be there when the time is right to close it, you have to manually enter another order to exit the position. As you probably know, the entire process of managing positions is inefficient and prone to errors.

But when you use Exit Options, you can now pre-set your exit criteria so your bots can manage your positions automatically--every minute of every day. Plus, orders are only sent to the broker when your criteria is met, so you no longer need to worry about having resting orders exploited while sitting in an order book (say goodbye to stop-hunting market makers).

1-minute auto position management

Exit Options check your position every minute and send a closing order if your exit criteria are met.

Exit Options can run from 9:31 am ET until 1 minute before the market close. You can customize the Exit Options schedule in your Settings.

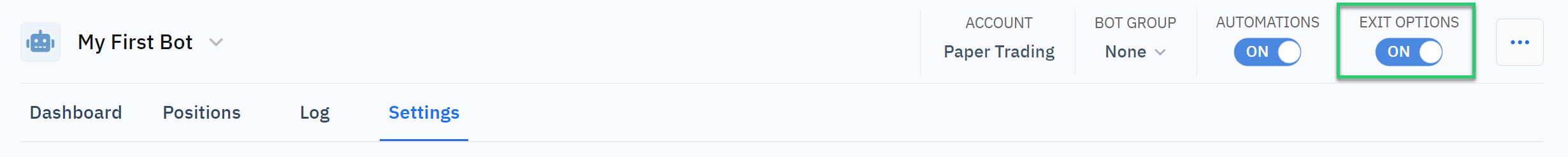

Exit Options always run, even if your automations inside a bot are turned off, so your positions are always managed, unless you turn off Exit Options in your bot (see below).

Exit Options use a position's mid-price when evaluating returns. (Note: you can use a bid-ask guard to disable Exit Options from closing a position or tracking the high % or low % of the position if the bid-ask spread is wide).

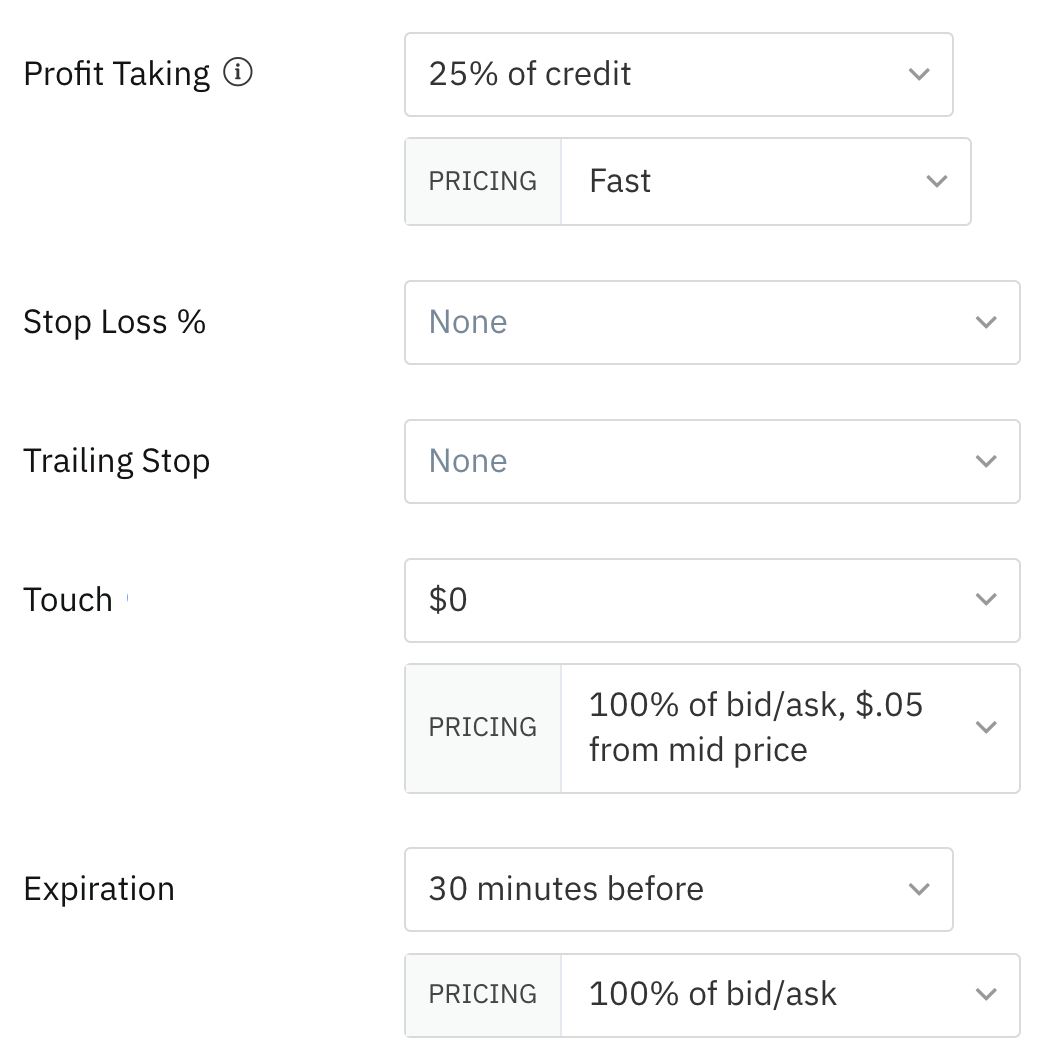

You can customize each position's Exit Options for specific management using six triggers:

- Profit Taking

- Stop Loss

- Trailing Stop

- Touch

- Expiration

- Earnings

Note: There is no guarantee that an order will fill in a live market. It is possible that a position won't close when an order is sent to your broker for execution. Markets move fast, and bid-ask spreads can be volatile. Orders triggered by an exit option will remain active for two minutes; during that time, no additional orders will be sent to your broker. If the order is not filled, exit options will resume checking the position at the next 1-minute interval.

Exit Option closing orders

You can use SmartPricing when closing a position, turn off SmartPricing, or use a market order.

Exit Option orders are automatically canceled after two minutes. If an order is not filled, Exit Options will check your position at the next interval and, if necessary, re-start the process of sending orders to your broker if the exit criteria are still met.

Profit-taking Exit Options set the final price to your profit-taking level to ensure your minimum profit target is received if the order fills.

The Before Expiration and Before Earnings triggers operate based on calendar days in the same way 'days to expiration' is calculated and will execute at 3:29 pm ET if using a day-based selection. For example, if today is Friday, a position expiring on Monday is considered 3DTE. When using an exit trigger for Before Expiration or Before Earnings, it's the traders responsibility to be aware of how weekends and market holidays will affect the contract's days to expiration value.

If you check the PDT box, the bot will wait at least one day to close a position to avoid pattern day trading.

We can also use the bid/ask guard to protect from temporary price fluctuations. You set the maximum width of the position's bid/ask spread you are comfortable with, and if the position exceeds this value, it will disable Exit Options from closing a position or tracking the high % or low % of the position until the bid/ask spread is below your setting.

Save your Exit Option criteria as a Preset to be reused for similar position types. You can name your presets for easy identification. All Exit Options will automatically populate when you use a Preset.

Using Exit Options

You can set your Exit Options for any trade when opening positions manually or in an automation's Open Position action. When using Exit Options in an Open Position action, all positions opened in the automation will have the same entry criteria. Once opened, Exit Options are specific to each position. You can always edit each position's Exit Options at any time after it is opened.

Additionally, you can enable and disable Exit Options from the main Bots page, inside of the bot as shown below, or individually within each position.

Watch this workshop for an in-depth look at Exit Options: Introduction to 1-Minute Automated Exit Options.