Low volatility trading can be difficult for option sellers. When markets are calm, premiums are small and narrow, and it's more difficult to sell options for a good reward/risk value.

So what's a trader to do? Staying active and keeping position size small is important, but you also don't want to force trades into the market that aren't right.

Best options strategies for low volatility

When volatility is low, options tend to have lower premiums, making it less expensive to enter long option positions.

Long options and vertical debit spreads benefit from rising volatility and a directional move. So if a certain ticker, or the market in general, is in a period of low volatility, you may want to consider using long calls, long puts, long call spreads, and long put spreads.

Visit Options Pricing for a complete guide to options contract pricing, volatility's impact, intrinsic and extrinsic value, options greeks, and more.

Below we’ll explore three options strategies you can use during times of low volatility.

How to find options strategies in low volatility markets

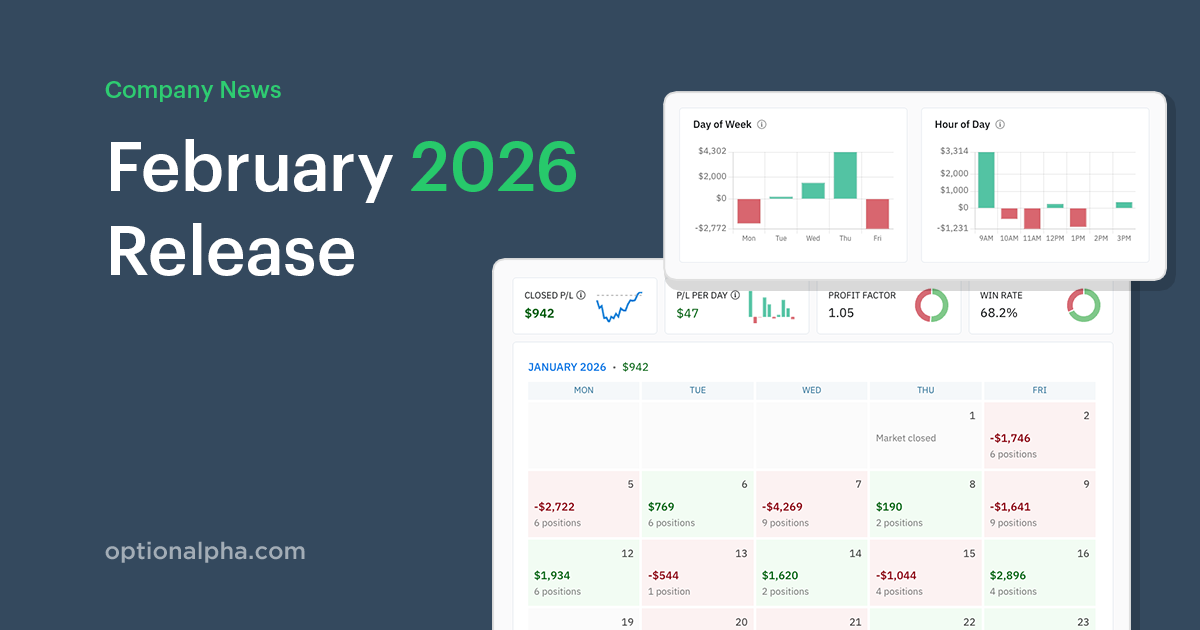

Option Alpha's Trade Ideas includes credit spreads and debit spreads to make it easier to find opportunities in any market. Trade Ideas analyzes and displays millions of potential opportunities using live data. We can filter for credit spreads and debit spreads to focus on tickers with high volatility or low volatility. We can also filter positions using reward/risk, probabilities, Alpha, EV, IV rank and more, then sort the potential trade ideas for each column.

Trade Ideas is a powerful tool to discover potntial trades based on current market conditions.

Watch below to see how I filter specifically for only debit spreads, something I like to do when volatility is low.

How to screen for tickers with low volatility

When volatility is low, a simple way to identify potential tickers to trade is to filter for low IV rank. We can also use RSI to help find a directional bias.

For example, we can use the Screener to focus on liquid symbols with an IV rank below 25 and an overbought RSI above 70. This produced a list of three stocks that meet our criteria:

Next, we'll copy and paste those symbols into Trade Ideas to look for bearish debit spreads with a reward/risk greater than 100% and positive Expected Value:

Then, we can choose a trade from the list of opportunities that meets our position sizing risk management rules. For example, this KO long put spread has the highest Alpha and only $31 of risk, with a 212% reward to risk and +$10 EV. The breakeven price is just below the stock's current price. If the stock declines and volatility increases, this position has a chance to make a profit.

Single-leg long options

Long calls and long puts are risk-defined strategies with a bullish and bearish directional bias, respectively.

Long Call

A long call option is bullish strategy and leveraged alternative to buying stock. Long calls are typically cheaper during low volatility and will profit from a combination of the stock price going up and/or increasing volatility.

Long Put

A long put option is bearish strategy and leveraged alternative to shorting a stock. Long puts behave similar to long calls: increasing volatility will cause the option price to increase, so they can be a good strategy if you think a stock will decline and volatility will go up.

Long options can be a good way to make small, risk-defined, directional bets on overbought and oversold stocks.

Get a free copy of our in-depth "RSI Signals" research report today. Instantly download 20 years of performance data for 700+ RSI signals. Click here: RSI Signals Research

Debit spreads

Debit spreads consist of buying one option and selling another. Buying a call debit spread -- buying a call and then selling a call at a higher price -- is a directionally bullish position. Conversely, buying a put debit spread would be a directionally bearish position -- buying a put option and then selling a put option at a lower strike price.

Like single-leg long options, debit spreads have defined risk: the cost to enter the postion is the max possible loss for the trade. However, while long calls and puts have unlimited profit potential, debit spreads' max profit is capped by the spread width less the debit paid. But, selling the additional call or put reduces the position's cost and, therefore, its risk.

For example, as you ca see in the payoff diagram below, if a $5 wide bull call debit spread costs $2.00, the maximum profit is $300 if the stock price is above the short call at expiration, and the maximum loss is $200 if the stock price is below the long call at expiration. The break-even point would be the long call strike plus the premium paid.

Long call spread

If you’re bullish, you may consider a long call spread. Also known as call debit spreads and bull call debit spreads, long call spreads are multi-leg, risk-defined, bullish strategies with limited profit potential.

Long put spread

Long put spreads, also known as put debit spreads and bear put debit spreads, are multi-leg, risk-defined, bearish strategies with limited profit potential. In addition to capitalizing on rising volatility, the strategy looks to take advantage of a decline in price from the underlying asset before expiration.

Debit spreads vs. Credit spreads

Debit spreads and credit spreads each have their own unique characteristics that are suitable for different market environments.

Debit spreads are directional options buying strategies where you are net paying for an options spread. Credit spreads are a net selling strategy where you traditionally sell a spread out of the money.

Debit spreads and credit spreads are very flexible. They can be entered many different ways to create different probabilities and reward/risk profiles based on the contract's moneyness. For example, far OTM credit spreads and deep ITM debit spreads will have higher probabilities of profit but a lower reward/risk. Debit spreads are typically used as a more aggressive directional strategy, while credit spreads can profit if the stock doesn't move much, implied volatility decreases, and theta decays the option's value.

Don’t miss Podcast 116: Debit Spreads vs. Credit Spreads – When to Use Each

.png)