Options settlement is the process of satisfying the terms of an options contract when the contract is exercised. The rights and obligations of the two parties are fulfilled through the contract settlement.

When an options contract is exercised or assigned, the clearing organization facilitates the options contract’s settlement. Settlement can be physical delivery of the underlying security or commodity or cash-settled through an exchange of money.

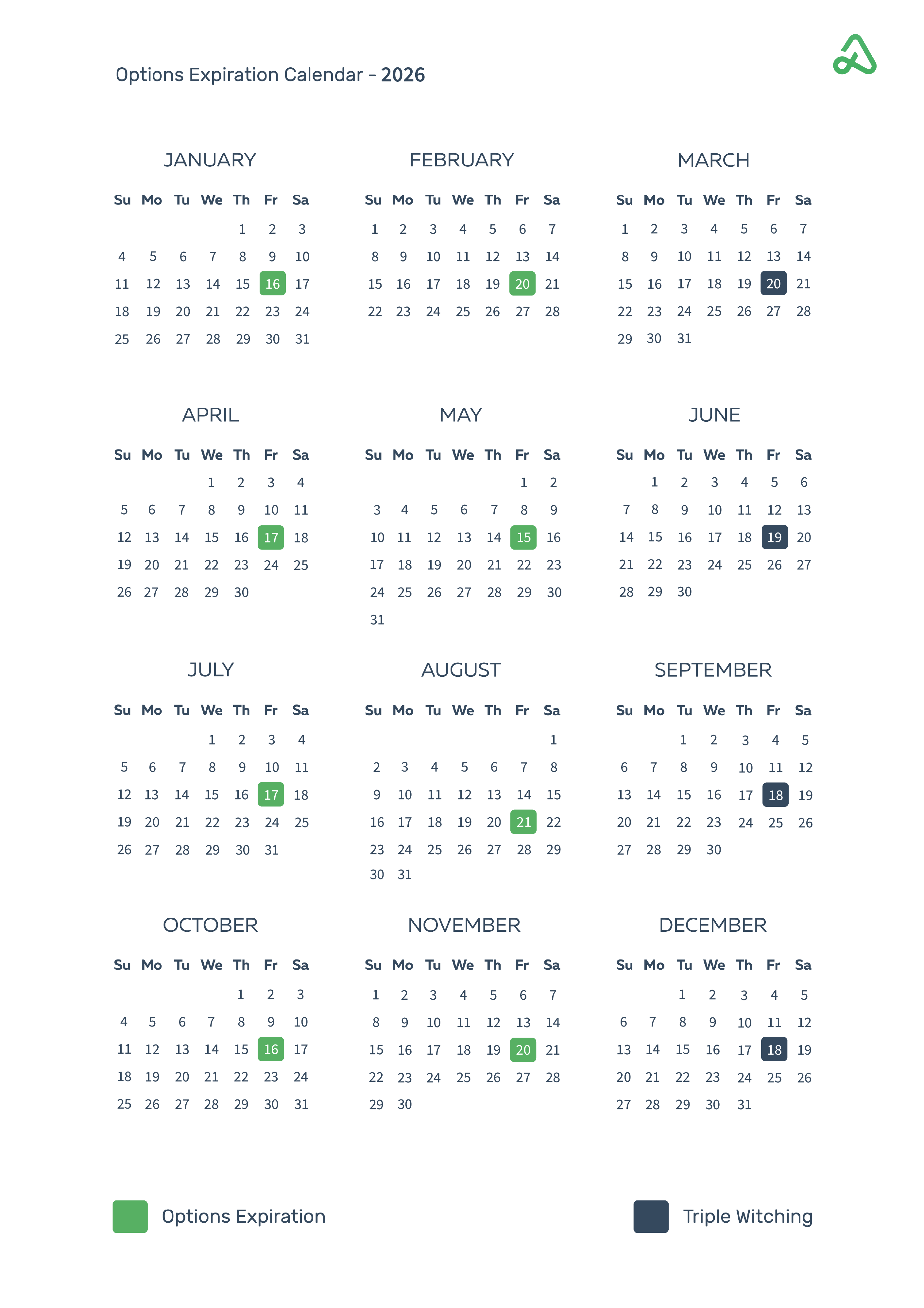

Options expiration

Options expiration is the last trading day for exercise and assignment. The expiration date and time is standardized based on the terms of the options contract. Options contracts that expire in-the-money are typically exercised automatically by the brokerage firm that holds the account.

For equity options, an in-the-money call option is typically converted to long shares of stock, and in-the-money put options are converted into short shares of stock at expiration.

If the contract buyer (long the options position) does not want an in-the-money contract to be automatically exercised, then the contract must be closed prior to the expiration time on the expiration date.

Options contracts that expire out-of-the-money will expire worthless and are removed from the trading account with no further action needed. Most options contracts are closed before expiration and do not go through the exercise and assignment process.

Brokers may charge additional fees if an options contract is not closed prior to expiration and is automatically exercised or assigned.

Exercise & Assignment

Exercise and assignment of options refers to the process of settlement in accordance with the terms of the contract. Exercise and assignment of options contracts are two sides of the same transaction.

An option buyer has the right to exercise an options contract. An options seller is obligated to accept assignment from an exercised options contract.

Exercising options

An options holder has the right to exercise their stock option at the option’s strike price. Options buyers are the only party that can exercise an options contract. For example, someone who is long a call option may choose to exercise the call option and buy shares at the contracts strike price.

The decision to exercise depends on the options contract’s specifications, whether it is an American or European-style option, the underlying’s current price, the options contract’s strike price, the length of time remaining on the options contract, and the option holder’s outlook on the underlying security.

For options contracts where there is no physical delivery of the underlying (shares of stock, barrels of crude oil, etc.), the exercise settlement value is determined at expiration and a cash settlement amount is calculated. When an options contract is exercised, the owner of the option invokes the right to buy or sell.

Options exercise is the process of converting an options contract into the underlying shares of stock. Exercising an options contract is irrevocable as exercise begins the process of assignment by the Options Clearing Corporation (OCC).

Options contract buyers may exercise the contract anytime before expiration with American-style contracts. Exercising prior to expiration may occur for a number of reasons, such as the desire to receive a dividend payment on the underlying stock or to fulfill an obligation for another position in the portfolio.

Options assignment

The assignment process is facilitated by the OCC.

For example, a call option holder sends an exercise notice to their broker. The broker then sends a notice of exercise to the OCC. The OCC randomly selects a clearing member firm who is short the exercised contract and assigns the firm the exercise. The clearing member firm assigns the exercise to one of its customers (either randomly or on a first-in, first-out basis) who holds the short position. The assigned call writer must deliver the shares to fulfill the obligation of the assignment. The broker then delivers the call writer’s shares to the OCC who delivers the shares to the broker whose customer initially exercised the call option.

Early assignment

Early assignment is the assignment of an options contract before the expiration date. Early assignment of options contracts is only possible with American-style contracts. Once an options contract has been sold, the writer of the option is at risk of early assignment and accepts the responsibility of obligation to fulfill the terms of the contract.

Early assignment may happen for a number of reasons. For example, early assignment may happen because the contract holder wishes to receive a dividend payment from the underlying security. Early assignment may happen because a trader with another position was assigned a contract and is short shares of stock.

Random assignment

The OCC uses a random assignment process to ensure fairness in the distribution of options assignments. The OCC randomly selects a clearing member account maintained with the OCC for the assignment. The assigned brokerage firm must then use one of two methods to notify its accounts of the assignment.

The two approved methods for assignment are random or first-in, first-out.

Assignment risk

Equity options sellers are at risk of assignment at any time. However, it is usually in the option buyer’s best interest not to exercise an options contract early, but there are circumstances that increase the risk of assignment. The majority of options exercises, and therefore options assignments, occur near expiration.

In-the-money options contracts with time remaining until expiration have both intrinsic value and extrinsic value, so assignment does not typically occur until the majority of the time value has decayed and expiration is near.

In-the-money put options are more likely to be assigned early than in-the-money call options because exercisers of put options sell stock and receive cash. Exercisers of call options purchase stock and must pay cash; therefore, the time value of money impacts the decision to expend cash early prior to expiration.

Risk of early assignment of a short call option position is greatest when the underlying security pays a dividend, the call option is in-the-money, and the time value of the option is less than the dividend amount.

For a call option holder or buyer to receive the dividend payment from an exercised option, the exercise must happen on or before the ex-dividend date of the underlying security. A notice of assignment in this case typically happens on the ex-dividend date.

A short call option that is in-the-money is most at risk of dividend assignment. In-the-money short call options are at risk of early assignment during dividend payment dates when the value of the corresponding put option with the same strike price as the call option is worth less than the dividend payment amount.

Closing assigned positions

When a call option seller is assigned a position the seller is obligated to sell shares of the underlying stock or deliver the underlying commodity at the contract’s strike price. To fulfill the obligation of the exercised contract, the seller must deliver 100 shares per contract, in the case of equity options, of the underlying security at the contract’s strike price.

If the seller owns shares of the contract’s underlying security (as is the case with a covered call, for example), the long stock position in the seller’s account will be used to honor the assignment. If the seller does not hold shares of the underlying security, the seller’s account will show a short position in the underlying security. To cover the short shares, the seller must purchase shares of stock at the current market price to reverse the trade and close the position.

When a put option seller is assigned a position, the seller is obligated to purchase shares of the underlying stock at the contract’s strike price. Typically, the seller’s account had the margin required to purchase the stock held in reserve to offset the potential assignment of the put option.

For example, if the seller opens a short put contract of a stock at a strike price of $50, they would need to have $5,000 available in their account at the time they opened the option position to cover the cost of buying 100 shares of stock.

Once assigned, the seller is now long the underlying security and can either continue to hold stock or sell the shares at the current market price to close the assigned position.

Dividend assignment

Dividend assignment risk is the risk of being assigned the obligation to pay a dividend on a short call position. Call options sellers may be assigned the responsibility of paying a dividend.

Because call options sellers are short the underlying security when the security goes ex-dividend, the seller may owe the dividend on the security. The amount of the assigned dividend payment is then deducted from the seller’s account. Because of the additional cash outlay from the dividend payment, dividend assignment risk increases the maximum loss potential on a short call option position.

Dividend assignment risk is greatest on or just before the ex-dividend date.

Physical settlement

Physical settlement of options contracts is the most common form of settlement and involves the physical or actual delivery of the underlying security at settlement.

Physical settlement of a long equity call option, for example, would be the purchase of 100 shares of the underlying security at the contract’s strike price. Physical settlement of a long equity put option would require selling 100 shares of the underlying security at the contract’s strike price.

Options contracts that are physically settled tend to be American-style option contracts where early exercise is possible.

Cash settlement

Cash settlement occurs when cash exchanges hands at settlement instead of an underlying security or physical commodity. Cash settlement is primarily used with index options because an index is not deliverable.

When the options contract holder exercises an index option (buyer), the difference between the options contract strike price and the underlying index price is paid to the holder from the options contract writer (seller).

For example, if the exercise settlement value--the underlying index price for which settlement will be based--for SPX is 3100 and an SPX 3050 call option is exercised, then the cash settlement for the call option buyer would be (3100 - 3050) x $100 (the contract multiplier) = $5,000.

Cash settled contracts typically have European-style expirations and can only be exercised on the settlement date.

Settlement timelines

Settlement timelines vary based on the type of options contract. For example, equity options are P.M. settled while VIX index options and some SPX index options are A.M. settled.

Buyers of options contracts may exercise their option any time prior to the expiration time on the expiration date for American-style contracts or on the expiration date for European-style contracts.

Brokerage firms may set an earlier exercise notification time in the day on the expiration date than the exchange where the option is traded.

When an options contract is exercised, the decision is irrevocable. Once exercised, the options contract seller will be responsible for honoring their obligation, and settlement will occur.

Brokerage firms will deliver notice of the assignment on or before the business day after the assignment. The terms of the contract must be fulfilled, such as purchasing shares at the strike price for put options or selling shares at the strike price for call options.