Almost one year ago to the day, we analyzed over 25,000 0DTE options trades to assess how Option Alpha traders leverage automation to set up and execute same-day strategies. Last year’s blog focused on the most popular symbols and strategies, highlighting position details, successful setups, and automating 0DTE trades.

Now, with 10x the data, our goal is to uncover what successful 0DTE traders are doing so we can assess quantitative statistics that impact performance and apply it to our trading. Nothing has ever been done on this scale at the retail level with live data.

This research explores the variables that successful short-term traders have in common here at Option Alpha. We’ll also dive into specific autotrading strategies and share the advantages of automating key components, such as entry and exit time, profit targets, stop losses, and market conditions.

Want to see recently updated 0DTE research insights? Visit: New Research on SPX Intraday Price “Pegging” for 0DTE Traders

0DTE Review: 1 Year & 200k Trades Later

0DTE trading continues to be a very popular strategy, both inside Option Alpha and in the options trading market as a whole. In fact, our traders have opened and closed 200,000 0DTE trades in Option Alpha since last year’s research report, bringing the total to 230k at the time of this research.

Most popular symbols and strategies

Similar to last year’s research, traders continue to open the vast majority of 0DTE positions in SPY, although the total percentage of SPY trades has decreased from 88% to 81%. QQQ was the second most popular symbol, while all other tickers combined for less than 6% of positions. This makes sense considering SPY and QQQ now offer daily expirations, a change to the 0DTE landscape that occurred in late 2022, as you can see in the image above.

Likewise, iron butterflies are still the preferred strategy type for Option Alpha 0DTE trades. Including iron condors, neutral strategies accounted for twice as many positions as directional credit spreads.

Best days to trade 0DTE

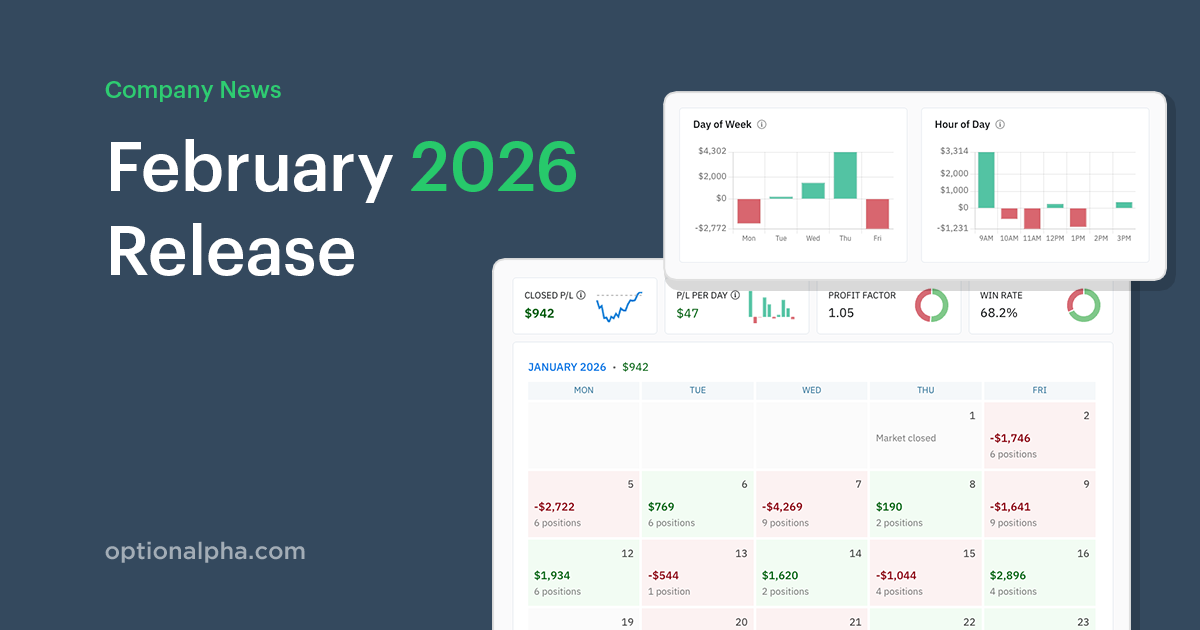

One interesting metric we added to this study was examining if the day of the week had a significant impact on profitability. And, in fact, it appears that it did. Monday was by far the most profitable day for 0DTE strategies. Tuesday, Thursday, and Friday all had a negative P/L.

Are 0DTE Traders Successful?

The short answer is... yes. And no.

At first glance, 0DTE options strategies seem to be nothing more than a fair coin flip.

49.64% of Option Alpha traders using a 0DTE strategy are profitable, which is interesting in its own right, considering many traders already consider 0DTE trading to be a 50/50 bet.

However, there are observable commonalities amongst successful short-term traders at Option Alpha.

Characteristics of Profitable 0DTE Traders

This research represents the activity and habits of the roughly 20% of Option Alpha 0DTE traders who have over 100 trades and are net profitable. 100 trades were chosen arbitrarily but should provide a “good enough” filter to represent a serious 0DTE trader.

The results provide an overview of the trading behaviors and performance of profitable traders for different strategy types, holding periods, and entry and exit conditions.

The research showed that three key variables led to better performance:

- Strategy type

- Entry & exit times

- Profit targets & stop losses

Neutral strategies

Neutral strategies were not only the most popular setups, they also had the best performance overall. Iron butterflies and iron condors comprised 78% of 0DTE positions and had win rates of 66.76% and 70.19%, respectively.

Entry & exit time of profitable trades

Most profitable trades were entered after the morning volatility and remained open for an average of approximately two hours. Broadly, consistently profitable traders opened positions at approximately 10:15 AM ET and closed shortly after 12:00 PM ET.

Optimizing profit targets and stop losses

Next, we wanted to determine what the most common exits were for both profitable and losing trades since the majority of these trades were not held until expiration.

The average percentage gain and loss for each strategy type highlights where successful traders are putting their profit-taking and stop losses.

The data shows that targeting iron butterflies with small profit targets and stop losses led to successful trading based on the research. Profitable Option Alpha traders opened trades at 10:15 am EST on Mondays and Wednesdays and closed the position when it hit a profit of 15%, cut losses at -25%, or exited the trade at 12:00pm EST if neither exit criteria were met.

Key Factors of Profitable Positions

We then wanted to focus on the specific data points that led to positive returns.

Here are the complete calculated statistics for all strategy types used by profitable traders with more than 100 trades:

- Average trade duration

- Average gain

- Average loss

- Average risk

- Average contracts

- Percentage of winners

- Percentage of losers

- Average RoR for profitable trades

- Average RoR for losing trades

- Average dollar profit for profitable trades

- Average dollar loss for losing trades

- Average profit/loss per trade

- Average time after market open that profitable trades are opened

- Average time before market close that profitable trades are closed

- Average time after market open that losing trades are opened

- Average time before market close that losing trades are closed

Out of curiosity, we also wanted to see if there was a similar "seasonality" phenomenon for profitable traders. Indeed, the day of the week the analysis holds true for profitable traders as well. Monday and Wednesday were net profitable, while Thursday maintained consistently negative returns.

Finally, we analyzed performance as "buckets of risk" to determine if there was a relationship or impact between how much is being risked on each trade and its outcome. There did not appear to be any discernible pattern between the amount of risk and performance. 0DTE strategies win fairly consistently, and risking more money does not increase those odds.

It's interesting to note that based simply on strategy selection as a % of the population, profitable traders are choosing iron butterflies, short put spreads, and short call spreads as the bulk of their trading, whereas iron condors ranked 4th in popularity. This contrasts the larger population of all traders, where iron condors are 3rd most popular, however slightly.

This may indicate that the secret to consistent profitability is some level of directional bias, which contrasts many popular 0DTE neutrality "best practices." So, we dug a little deeper to see if there were an optimal set of market conditions and position settings we could identify that led to consistently profitable returns.

Analyzing Market Conditions for 230k Trades

We created a study using IV Rank (IVR), short-term Simple Moving Averages (SMA), and a medium-term Relative Strength Index (RSI) to analyze performance metrics such as Win Rate, Profit Factor, and Average P/L. The study included all 230,000 trades under observation, not just the profitable trades.

We kept the indicator study simple, looking at the 5-day and 10-day SMA as well as 14-day RSI values.

For SMA, we used the symbol's open price on the morning of the 0DTE trade when comparing values. The SMA5/10 Buy condition is true when the symbol's open price was greater than the 5/10-day SMA. The SMA5/10 Sell condition is true when the symbol's open price was less than the 5/10-day SMA.

Although only one result appears in the condensed list below, an RSI buy signal was below 30, and the Sell signal was above 70.

Any of the 230k trades in the dataset that matched one of these conditions was included in the metrics calculation for that condition. This indicator study is not meant to be comprehensive, but the results were interesting nonetheless.

Top Performing 0DTE Strategy Setups

The following data was filtered to omit conditions where the Average P/L per trade was less than $0 and fewer than 1,000 samples of that trade type. Here is a subset of the more interesting results:

What stands out immediately is the favorable SMA5 conditions with high sample rates, indicating the results were repeatable over a high number of occurrences.

What's most fascinating is that the data supports taking contrarian setups, i.e. a bearish position when the SMA5 Buy signal triggers and a bullish position when the SMA5 Sell signal triggers.

Short call spreads with a SMA5 Buy signal and short put spreads with a SMA5 Sell signal had a profit factor over 2.0 and a win rate above 75%. Combined, those two conditions represent approximately 17% of all trades made by OA traders.

To give you an idea of the trading landscape, the first Option Alpha 0DTE trade was executed on September 2021. As of this writing, that’s 483 trading days. In SPY, where 81% of these trades occurred, 247 days saw the open price > 5-day SMA and 236 days saw the open price < 5-day SMA, nearly an even split.

The trades in this data did not exclusively consider SPY. In total, 59 underlying symbols were traded over 340 0DTE trading days, although 98% of the volume came from SPY, QQQ, and IWM.

Cumulative Performance of Directional Credit Spreads

Finally, we were interested to see what happens if we considered all of the trades made under the given conditions, so we plotted their performance as cumulative P/L over time:

Imagine if, since its inception of autotrading in late 2021, Option Alpha was a giant hedge fund comprised exclusively of thousands of 0DTE autotraders. Now also assume that our investment thesis indiscriminately allowed any 0DTE trade that is:

- a short put spread when the underlying 5-day SMA is a Sell

- a short call spread when the underlying 5-day SMA is a Buy

with discretion for trade management left completely up to each individual trader. An average of 8 contracts per trade over 37,894 trades and 3 years later...

Conclusion & Considerations

For some, these results may not be surprising. There have been rumblings in the 0DTE underworld for some time about optimizing directional bias, or at minimum legging into sides of an iron condor, which is just a composition of a short call spread and a short put spread.

Perhaps these findings are just a restatement of that idea. And perhaps the SMA5 conditions are just an oversimplification of a directional bias indicator and there are ways to collect more premium for the other side of an iron condor by entering later in the day, which is what some of the more advanced 0DTE traders have been known to do.

Late 2022 was also prime market conditions for 0DTE trading. Ironically, the introduction of daily expirations in SPY and QQQ actually triggered a slowdown in 0DTE activity, not only in trade volume but also in profits. You can see this in the graph above as we entered 2023; dollar returns ceased their exponential ascend.

A word of caution on these results: there are some caveats. Again, these trades were indiscriminately chosen, with complete disregard to things like overlapping strikes and portfolio risk. Maybe this strategy does work in the real world with thousands of individual traders trading separate accounts, but the assumption here is that each trade is performed in a vacuum.

This performance graph also disregards any in-the-money override actions where the true profit/loss is not known. Most 0DTE traders are aware of assignment risk trading so close to expiration, so they are proactive in closing trades manually before the end of the trading day.

In the ~230k trades studied, less than half of 1% (0.005%) were overridden on or after 3:50 PM ET as part of Option Alpha's expiration protocol. It is not a statistically significant number, but it's also non-zero. If those trades were full losses at expiration, they would affect the overall returns shown above.

0DTE: Advantages of Automation

Bots enable us to automate strategies using the research data that had the most success.

For example, we created a bot template leveraging the entry criteria based on the SMA research. Every Monday and Wednesday morning, the bot opens a counter-trend credit spread . We can easily identify the short-term trend with a decision action and use bot tags to open the corresponding position type. The bot will select option legs, filter pre-trade entry criteria, and calculate position sizing automatically.

Smaller profit targets and stop losses played a major role in successful trades. Profitable traders actively managed their positions with automated Exit Options, closing trades with defined profit targets and stop losses.

*All bot settings are customizable after you clone the pre-built template. Adjust any criteria to fit your preferences, including account size and risk tolerance.

All research data is anonymous. No personal identifiers or brokerage account information is ever used. Trade statistics that come directly from the platform include only non-identifiable position details such as entry and exit date, strategy type, underlying symbol, and performance metrics. Our research team analyzes this anonymized data to better understand how traders use our platform and share objective research insights with our community.

.png)